As in-store retail media continues to scale, one question keeps coming up. How many screens do you really need to drive meaningful ROI? In this blog, we break down the common misconceptions around revenue forecasting—especially the myth that more screens always mean more revenue—and share a smarter, data-backed approach to building a profitable in-store network.

Forecasting ROI: why more screens aren't always better

The digital out of home (DOOH) industry has converged with retail media networks, the tipping point for pilots already happening. With this steep growth comes challenges and chief among them is revenue forecasting.

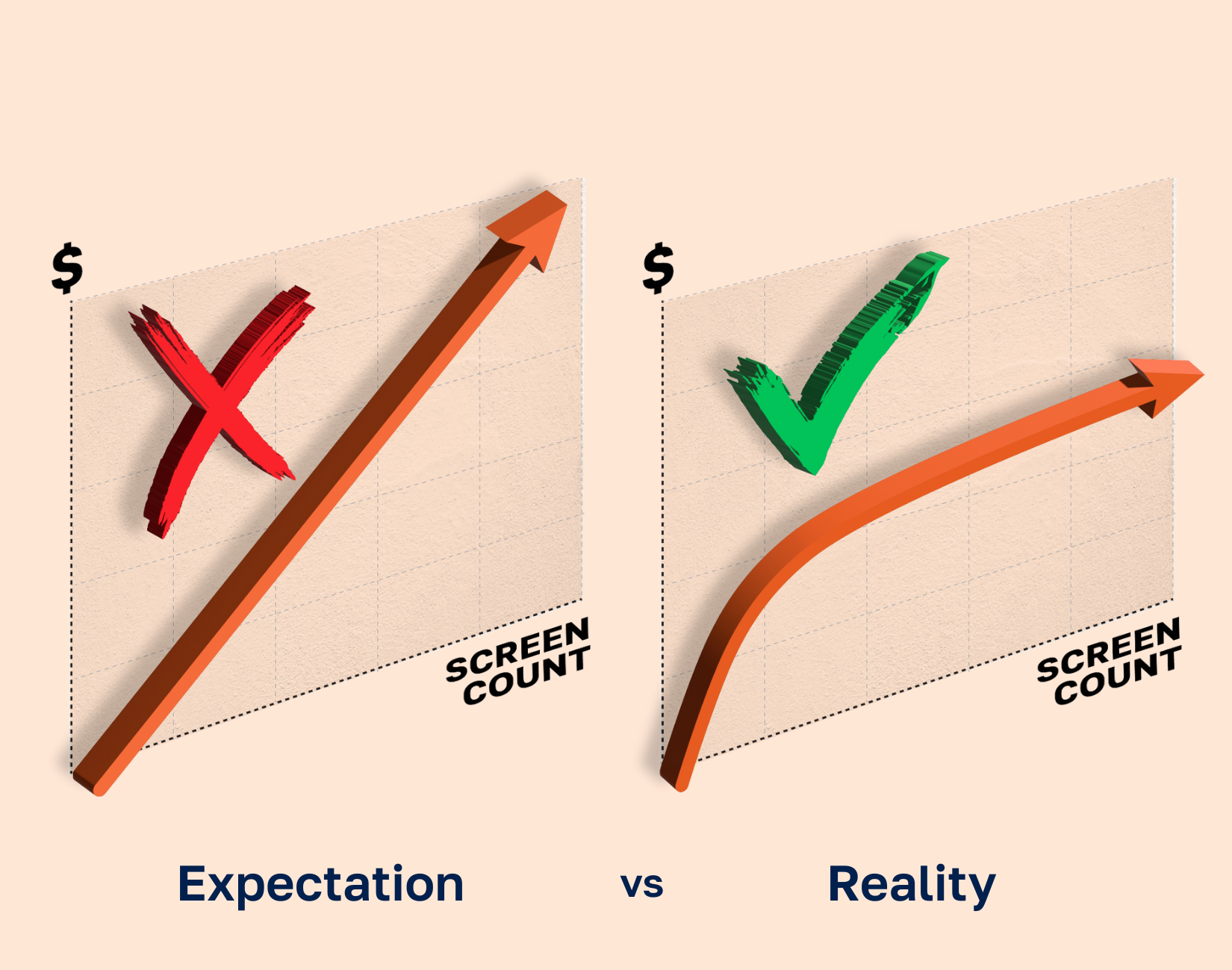

Building an in-store retail media network is a major investment in terms of time and cost. As with any investment, understanding the potential ROI is the first step in the journey. In just the last few months, we’ve reviewed dozens of in-store revenue models and they all suffer from the same fatal flaw; they show a linear relationship between revenue and screens.

These models forecast that more screens always equals more revenue. 10 screens = $10,000, 100 screens = $100,000 and so on.

At Vistar, experience monetizing digital signage tells us this business doesn’t work that way. In fact, there is an optimal screen count at which you maximize your ROI but beyond which you lose money on each additional screen. Finding this optimal screen count allows you to make the most of your investment without sacrificing customer experience or overburdening operational teams. It also makes it easier for your CFO and other key stakeholders to get on board.

Building a smarter model: the Vistar approach

We wanted to help retailers make the best decisions for their businesses. Seeing that the linear approach was wrong, we decided to let common sense, shopping behavior and the right metrics drive our model.

A better model had to do a few things:

- Accurately forecast total revenue and profit

- Pinpoint the ideal screen count

- Use information retailers have readily available

Keeping these requirements in mind, we created a model that estimates the total audience size (impression count) within each zone of a store using some basic inputs (foot traffic, dwell time and screen placement). From there, we can estimate what percentage of the total audience a given screen or set of screens can capture.

For example: a zone within a store might see 1,000 customers per day. Our model might determine that those 1,000 daily visitors translate to a total opportunity of 10,000 impressions per day. That points you towards your upper bound on revenue. You can add more screens and capture more of the audience but you can never capture more than 10,000 impressions. There is a limit! This limit is reduced further if advertising only occupies a portion of the screen time. Typically retailers will want to segment their schedule for advertising, in-store promotions and other content. This “share of voice” breakdown needs to be accounted for.

Further, our experience helps us estimate realistic CPM and fill rate across both direct and programmatic advertising. In reviewing other models, we saw CPMs and fill rates that were unlikely at best and impossible at worst. To get more accurate fill rates and CPM inputs, we need to understand where ad budgets will come from.

For example: what percentage will come from trade versus national media? Is the merchant team well versed already in capturing incremental budgets for screens? Who will be doing the selling to agencies and brand marketing teams and how skilled are they in unlocking those brand budgets? These questions all play a vital role in the revenue calculations because even the best models fail if you don’t account for who is investing in the media.

Finally, to determine ROI, you need to understand timing, revenue and costs. Costs go beyond just the initial CAPEX. There can be ongoing costs for electricity, connectivity, software and people. Our model captures these parameters and shows when additional screens stop making sense. As a result, instead of a linear model, our graph flattens out and clearly shows the point of diminishing returns.

Conclusion: future-proofing your retail media investment

At Vistar, we believe building a successful in-store retail media network starts with common sense and is powered by the right data and insights. Our revenue model integrates proven metrics from DOOH and retail media, ensuring retailers can avoid costly mistakes and unlock the true value of their in-store screens.

The opportunity is enormous—but only if approached wisely. Before you invest millions in screens, take the time to understand your optimal footprint, your real revenue opportunity and how to align your media offering with advertiser demand.

Ready to see how Vistar’s tailored modeling can set your network up for success? Let’s talk.

-1.jpg)

.png)